How DocuWare Make It Easier For You In Processing Invoice?

1. What is invoice processing?

Typically, invoice processing is performed by the accounts payable department in larger organizations. In small to midsize companies, processing invoices might fall to general accounting departments, office managers or owners.

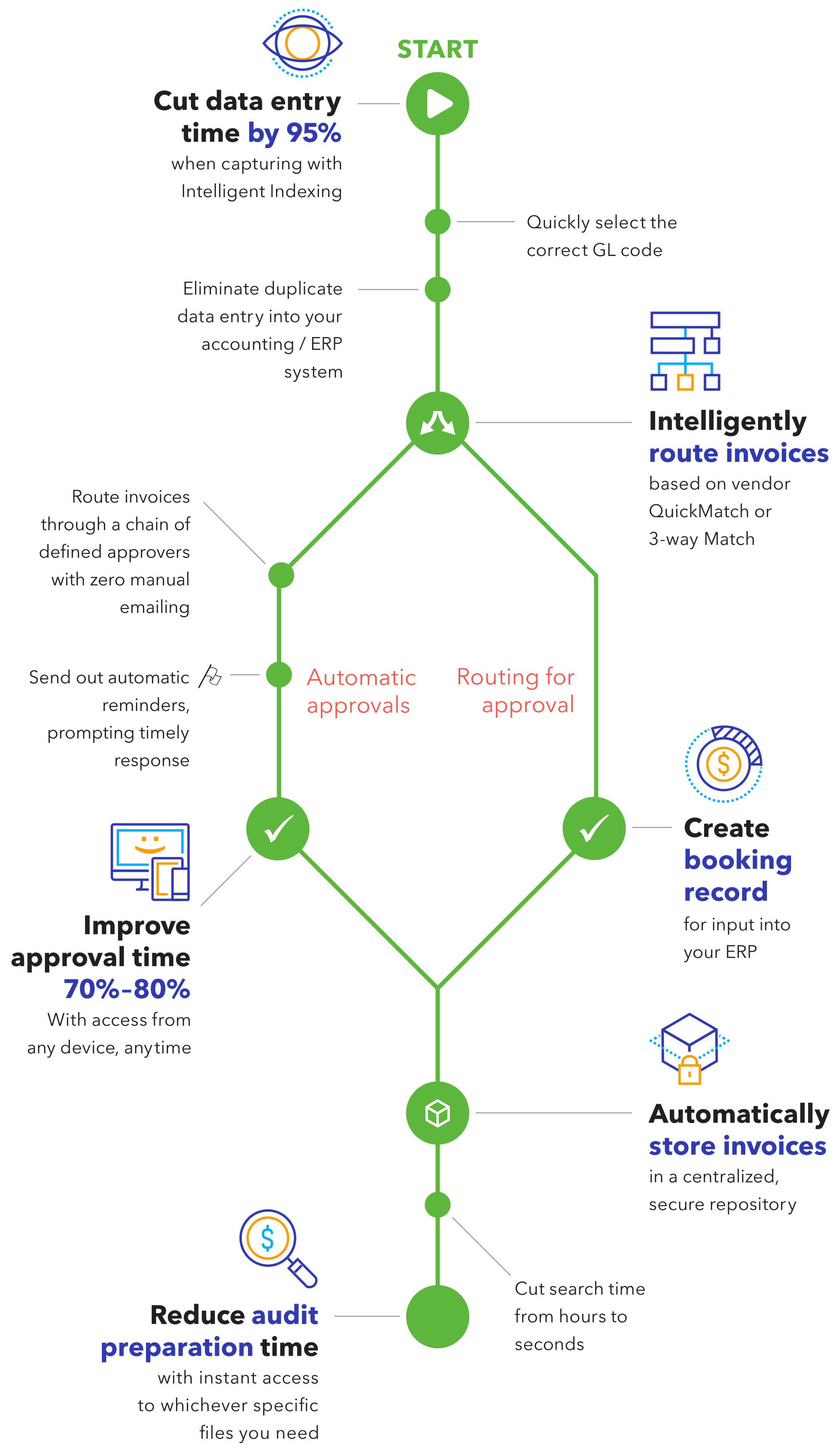

Figure 1. Invoice processing

Figure 1. Invoice processingIncoming invoices from a vendor or supplier need to be verified, approved, assigned GL account coding, and prepared for payment processing. Handling these invoices can be a simple or complex process depending on the rules of your company, and whatever approach you choose, you must follow compliance standards.

The most important factor is that incoming invoices are processed quickly, accurately, and digitally — and that the right people are in the approval workflow. This yields immediate benefits:

- Eliminate paper and manual data entry

- Automate workflow processes and exception handling

- Reclaim early payment discounts

- Dramatically cut audit prep time

The core process of digitizing incoming invoices, and how document management and workflow software can enhance, automate, and streamline the entire process.

Find out more about invoice processing below and learn:

- What invoice processing entails

- The steps to proper invoice processing

- How automated invoice processes can save time and money

- Best practices for using invoice processing software in your business

2. 5 steps for processing invoices

How invoices are processed varies from company to company. But whether you're processing and recording invoices manually or using invoice processing software and automation, some basic accounting principles are the same. Here are 5 common steps for processing invoices.

a) You receive the invoice

Invoices are received several ways, including, but not limited to:

- As paper documents that are received in the mail

- As email attachments

- As electronic documents transmitted directly into financial software or document management systems

- As faxes

b) The invoice is recorded and put into the process

The data you record and how you do it depends on your own processes, but at minimum, you need to know:

- The amount owed

- Who is owed

- Payment terms

- Payment components such as the cost of goods sold, shipping, taxes and fees

- What the invoice is for (either in general or in detail)

- Any category codes required for your own books

When processing invoices, organizations must first and foremost verify the accuracy of the information to avoid duplicate payments and fraud. Formal invoice verification involves the review of necessary and mandatory invoice data by the accounts payable department.

c) Taxes, fees, and totals

Figure 2. Income tax

Figure 2. Income taxVerification ensures the invoice amounts are correctly stated and calculated, including the correct tax rates, tax amounts and any other fees listed. The total amount and all other calculations are checked here as well, including entering the general ledger coding and the appropriate accounting period. In most cases, accounts payable also handles these tasks.

d) Order verification

Content verification determines whether the product being billed for was the one ordered and received. The number of items, quality and the agreed price are also checked at this point. These tasks are usually handled by clerks in the accounts payable department, receiving department or purchasing.

e) Fraud detection

Finally, every invoice undergoes fraud examination. Validating whether the vendor is known and approved, ensuring that invoices have not been sent more than once, and checking to verify that individual line items do not appear on more than one invoice are part of the verification process.

If done manually, verification is expensive and time-consuming. To realize leaps forward in efficiency, companies should optimize invoice verification as part of their accounting activity whenever possible.

Once the accuracy of an invoice is verified, depending on your business rules, it may be approved and sent to be paid. If additional approval is necessary, the invoice should be routed to the appropriate approver.

3. The invoice is approved

Processes for invoice approval vary by company and invoice type. Some invoices can be automatically approved while others might require the signature of a department head or executive.

Some common practices for invoice approval include sending the paper invoice or an associated form via interoffice mail to someone's physical inbox or doing the same thing via email. Neither of these approaches is especially productive; they both leave plenty of room for documents to get lost, people to drag their feet or misunderstandings to occur.

It's better to automate your approval processes as much as possible and keep approval workflows within your invoice processing system. That way, you can easily see where any invoice is in the process, how long someone has been sitting on an invoice and if someone is backed up with many invoices to approve.

4. Payment is processed

Once an invoice is approved, it can be put in line for payment. Typically, this simply means it's routed to a workflow so an accounts payable representative or other authorized employee can process payment.

To process payment, you typically need information such as:

- The total amount owed

- Who is owed, including name and address

- Any payment identifiers, such as accounts or invoice numbers, that should be included with the payment

- Types of payment accepted

5. Invoice and payment data are recorded and archived

Once payment is processed, final data can be captured and archived, as appropriate. General ledger entries for the payment debits and any other relevant accounting entries are made. With the right invoice processing software, such entries can be made with a few clicks of a mouse instead of numerous taps on the 10 -key, further reducing opportunities for error.

Finally, invoice images and supporting documents, such as purchase orders, shipping manifests and account approvals, can be saved in a secure, searchable document repository. That ensures they're ready for easy retrieval as needed, including during audits.

6. Major benefits of automated invoice processing

Figure 3. Benefits of automated invoice processing

Figure 3. Benefits of automated invoice processingEvery company has one thing in common: it processes invoices. Whether you're paying manufacturers for raw materials, wholesalers for products or vendors for services performed, you need a process to ensure payments are correct, made on time and follow your company policy.

You can ensure your invoice processing system is delivering benefits in addition to simply getting the payments out in the end. Some of the benefits of investing in automated invoice processing include:

- Reduced manual data entry. Strong invoice processes rely on electronic invoices or converting the paper invoices you receive into electronic form. This cuts down on the need for people to enter data into your systems manually. Document management software can scan invoices and extract relevant data more efficiently and accurately than people can. This saves your team time while reducing opportunities for costly errors.

- Greater reliability of invoice verification. Invoices are sometimes quickly “waved through” the process — especially during hectic times when employees are dealing with heavy workloads. With digital invoice processing, employees have access to all of the information immediately and authorize payments with speed, ease and accuracy. This drastically reduces the risk of invoices being approved without verification.

- Easy access to information anywhere, anytime. If an accountant, manager or staff member has questions about an invoice, then the necessary data and information can be retrieved and displayed at any time and in any location. This significantly increases the flow of information. The employees responsible can also retrieve information or approve invoices using their smartphone or tablet.

- Automated workflows. Automated workflows let you set rules-based processes that route invoices through the proper steps to payment. This ensures, for example, that a $50 invoice for office supplies isn’t held up waiting for an unnecessary signature from the CFO while a $3,000 invoice for new equipment does get routed for that potentially critical review.

- Increased number of early payment discounts. Strong invoice processing practices helps your company leverage more early payment discounts. For example, if you're on Net 30 but you get a discount if you pay Net 15, faster invoice processes are literally money in the bank.

- Reduced audit prep time. When invoices are captured and stored in an easy-to-use electronic system, you can prepare for audits or answer questions from business partners about accounts more quickly.

- Increased scalability. Technology-backed invoice processes are better suited to handling growing accounts payable needs. With the right system, you can scale up to higher volumes without hiring additional full-time AP staff.

- Massive cost savings. Invoice processing systems offer numerous ways to cut down on costs, including:

- Reduced overhead: You’re not paying to store and maintain so much paper.

- Reduced labour costs: Digital invoice processing is more efficient.

- Reduced spending: You’re able to get early payment discounts more often and save money on late payment fees.

a) Cleaner office space

Imagine no more filing cabinets, fewer printing devices, and shelves of storage reclaimed from paper and toner supplies — less shipping, less photocopying, less filing and searching. The first advantage is a cleaner, brighter, more spacious office.

b) Reduced business risk

Custom access controls and digital data security make it easier and less expensive to maintain compliance, reducing the likelihood that missing documents will result in fines or lost revenue.

c) Better customer relationships

Information is only seconds away with a quick search — no more putting people on hold to dig through folders. Deliver the speed and quality of support your customers and vendors deserve.

d) Increased visibility

Using digital workflows instead of paper results in greater transparency, allowing management to monitor business processes in real time for smarter decision making.

e) Positive environmental impact

If you have a “green” initiative in place, one of the easiest ways to reduce your carbon footprint is to print, ship and store less paper. Introducing digitization to any part of your business will help your organization go paperless.

f) Increased trust with suppliers

Invoice software lets you process payments faster and more accurately, which helps develop trust in the relationship between you and your suppliers. Better invoice processing allows you to quickly develop a reputation for paying your bills on time (or even early) and being a financially responsible client.

See how DocuWare's invoice processing software takes care of your invoice processing automation securely and easily.

7. General invoice process glossary

Understanding the common terms associated with invoice processing can be helpful when you're considering how to best deal with accounts payable in your business. Check out this brief glossary of general invoice and accounts payable-related terms.

- Invoice. A document, electronic or paper, that details an amount owed for goods or services. Learn more about different types and terms for invoices.

- Purchase order. A document, electronic or paper, that details what items are being ordered and whether they're approved.

- General ledger. The account book where debits and credits are recorded. Invoice payments are recorded as debits.

- Terms. How much time you have to pay an invoice.

- Due upon receipt. Indicates a term that requires the invoice to be paid immediately.

- Net. Indicates terms that require the invoice to be paid within a certain number of days, such as Net 15 or Net 30.

- Days payable outstanding. This can refer to how old an individual invoice is or how old, on average, all your open invoices are. A high average DPO is not usually a good thing, as it might indicate to your vendors and creditors that you're slow to process and pay your invoices.

8. 3 best practices for invoice processing

a) Invest in automation

Figure 4. Invest in automation

Figure 4. Invest in automationAutomation is foundational to strong invoicing practices. It's not that you want to or have to take people out of your processes — accounting processes do need human oversight and intervention. Automation is about eliminating tedious and unnecessary tasks so accounting staff can concentrate on more complex issues.

Here are just a few examples of how automated invoice processes can save you time and money while ensuring your invoices are paid faster overall:

- Automated workflow and exception handling. Establish automatic approvals based on amounts, vendor or other data, or set up a digital workflow to route to key decision makers. Deftly handle exceptions to ensure no balls are dropped.

- Automatic audit or review rules. Even if a purchase order matches the invoice, you may want someone to look at certain invoices. That might include invoices over a certain amount, those with a new payment address or the first invoice from a new vendor. Automated business rules can flag those invoices and route them to appropriate accounts payable team members for review.

- Set up payments faster. If you've already set up electronic payments for a specific vendor, you could have approved invoices queued up for payment. Someone might review the invoice quickly and simply press a button to release the payment, or you could have some invoices that get paid without anyone ever having to look at them.

b) Ensure secure storage

Invoice and payment data can be sensitive. It includes account numbers, business addresses and plenty of other information that could be used by cybercriminals. And even if you're not worried about hackers, imagine losing all of last year's invoices and the headache that would cause during tax time.

Secure storage of invoices is a best practice whether you're talking about documents in the current workflow or an archive held for compliance or audit purposes.

c) Invest in electronic signature

Figure 5. Invest in electronic signature

Figure 5. Invest in electronic signatureEven with automation, some invoices and related processes require an actual signature. Whether it's for the purpose of complying with regulatory rules or you simply want a sign-off on high-dollar invoices, managing paper-and-ink approvals gets messy fast.

9. How to digitize incoming invoices

With digital workflow automation in place to ensure invoices go to the right people as efficiently as possible, the next step is invoice approval, including escalation. There are four key steps to the automated invoice process.

a) Utilize capture and intelligent indexing

Invoices can come from anywhere: emailed PDFs, XML-only transmissions, faxed documents, even mailed paper. No matter what the source or format, the document management system intakes the invoices and starts the process of “reading” them.

Low-quality systems will simply capture an image of the document, and force users to input key data like totals, vendor, tax information, due date, and more. Some systems perform OCR to read the text to at least make it searchable but there is zero contextual business information.

The best document management systems use modern capture technologies to intelligently read the document, understand its content, and then push that data into key index fields.

This fully eliminates the need for manual data entry. The best systems use machine learning to learn the patterns and templates of invoices to get smarter over time and reduce the friction of incoming invoices even further.

b) Establish a rules-based automated routing workflow

Once the document management system intelligently indexes the incoming invoice and determines its content and purpose, it can use key index data like vendor, purchase order, address fields, totals and more to automatically decide how invoices should be processed.

For example, invoices from an approved vendor under a certain dollar amount can be automatically approved — with no human touch.

Invoices from an unknown vendor can start a new vendor workflow before any approvals happen protecting you from fraudulent vendors.

Invoices with large dollar amounts that require multiple levels of approval based on dollar thresholds or multiple cost centre approvals can be sent through a digital approval workflow based on your business rules. The workflow ensures the correct individual approves based on the set criteria in the system.

Once the key index data of an invoice is understood, digital workflow enables fully customizable automation to closely follow business rules.

The combination of intelligent indexing and workflow automation yields impressive time and cost savings at every point in the invoice process.

c) Automate invoice approval and system synchronization

Feature-complete document management systems will use workflow logic to expedite the fastest possible approvals with minimal exceptions.

Once invoices are approved and the process is completed, that data can be synchronized with financial applications like QuickBooks, Sage and other accounting systems. While native integrations are possible through APIs and prebuilt connectors, the universal method to export and import transaction data is through CSV files which sophisticated document management systems will produce.

Automating the incoming invoice process enables meaningful savings across many touchpoints.

d) Maintain secure and compliant archiving

The final step is securely archiving invoices in a legally compliant manner.

The invoice is archived in the document management software with retention policies applied. These retention policies are extensions of workflow and dictate when documents can be safely destroyed.

In addition, the safe archive of digital invoices — or any documents — will have robust access rights and data encryption to prevent tampering, loss and unwanted access. Security is one of the most important aspects of a document management system and is crucial to ensuring peace of mind at the end of a document’s lifecycle.

Ultimate Content Services Platform - DocuWare: Document Management And Workflow Automation

Ricoh now offers DocuWare – document management and workflow automation solutions, which have been around since 1988. DocuWare solution allows businesses to digitize documents, manage and work with business data with international security standards in the cloud, at corporate servers or a combination of both. From there, businesses can simplify your existing workflows quickly, focus on your core business and increase competition in the market.

Related articles

News & Events

Keep up to date

- 18Dec

Ricoh recognised as a Top 5 global AV Integrator in SCN Top 50 Systems Integrators 2025

- 11Dec

Ricoh Recognised as a Sustainability Leader in Quocirca's 2025 Report

- 07Nov

Ricoh Pro C7500 Gold Toner Brings Sustainable Luxury to Sun PhuQuoc Airways’ Travel Guide

- 31Oct

Ricoh perovskite solar cells installed on Japan Aerospace Exploration Agency cargo transfer spacecraft1 HTV-X1